Introduction to Longevity Investing

The pursuit of extending human healthspan, the period of life spent in good health, has become a significant focus for investors. Recently, Seveno Capital made its first investment and launched a $70m fund dedicated to ventures aiming to extend human healthspan. This move highlights the growing interest in longevity-focused investments, with the global longevity market expected to reach $52.4 billion by 2027, growing at a compound annual growth rate (CAGR) of 36.4%.

The Problem of Aging

As the global population ages, the burden of age-related diseases increases. Chronic diseases, such as diabetes, cancer, and cardiovascular disease, account for approximately 70% of all deaths worldwide. The economic impact is substantial, with the World Health Organization (WHO) estimating that the global cost of chronic diseases will reach $47 trillion by 2030. To address this issue, investors are turning to healthspan-targeting startups that focus on preventing, treating, or reversing age-related diseases.

Investment in Longevity

The launch of Seveno Capital’s $70m fund is a significant step in the right direction. This fund will focus on investing in startups that aim to extend human healthspan through innovative technologies and therapies. Some of the key areas of investment include:

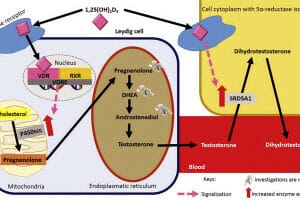

- _Senolytic therapy_: a approach that targets and removes _senescent cells_, which are thought to contribute to age-related diseases

- _Stem cell therapy_: a treatment that uses _stem cells_ to repair or replace damaged tissues

- _Artificial intelligence (AI) in healthcare_: the use of AI to develop personalized medicine and improve health outcomes

The Future of Longevity Investing

As the longevity market continues to grow, we can expect to see more investors turning to healthspan-targeting startups. In fact, a recent survey found that 71% of investors believe that longevity-focused investments will become a major trend in the next five years. As someone who has been following this space, I believe that the potential for longevity investments to improve human health and increase healthspan is vast.

Emerging Trends and Opportunities

Some of the emerging trends and opportunities in the longevity market include:

- _Personalized medicine_: the use of genetic data and AI to develop tailored treatments for age-related diseases

- _Regenerative medicine_: the use of _stem cells_ and other technologies to repair or replace damaged tissues

- _Digital health_: the use of digital technologies, such as wearables and mobile apps, to monitor and improve health outcomes

Looking Ahead to a Longer, Healthier Life

As the longevity market continues to evolve, we can expect to see significant advances in our understanding of aging and age-related diseases. With the launch of funds like Seveno Capital’s $70m investment, we are one step closer to a future where humans can live longer, healthier lives. As research in this area continues to grow, I am excited to see the potential impact that longevity investments can have on human health and wellbeing.